One of the most important parts of adulting is to make a budget. It’s also one of the most neglected. An efficient budget ensures all your expenses are accounted for and shows you a clear picture of where unnecessary spending is happening. While a pen and paper are sufficient for making a budget, there are budget apps that offer significant advantages. In this article, we will explore some of the best home budget apps that you can use to efficiently draft a budget and track both income and expenses.

Home Budget Apps for iPhone and iPad

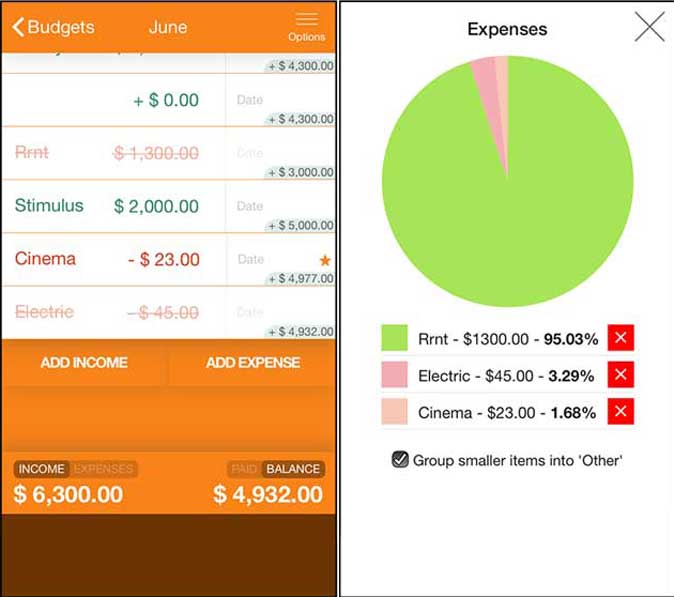

1. Fudget

The first app on the list is also one the simplest to use. There are no complicated graphs and plots to worry about. You simply choose a month, add your income and upcoming expenses for that month. The app shows total expenses and the amount left after everything is paid for.

You should get Fudget app if you just want an app to keep track of your expenses and show how much amount you spend on non-essential items. However, if you want more sophisticated app graphs, forecasts, and charts, there are better home budget apps below.

Fudget is free to use with a pro version that unlocks CSV export of your monthly budget and removes ads.

Pros

- Intuitive interface

- Visual charts

- At a glance expense report

Cons

- No custom lists or filters

- Lacks a dark mode

- No option to create multiple budgets

Get Fudget (free, iOS)

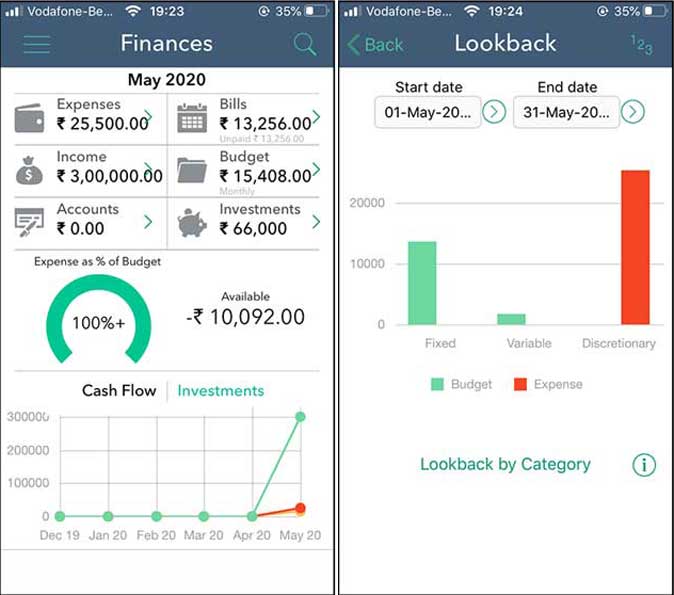

2. Finances

A little more advanced than the Fudget app, Finances is still a fairly simple app for home budgeting. Unlike other home budget apps, Finances makes budgeting easier. It already has categories for rent, utilities, groceries, and other common expenses, you just need to tap and log everything. There is an option for adding or removing a specific category.

One of the interesting features of this app is that it can give you a forecast of your upcoming budget based on your current trends. Also, you can export the entire data in a CSV or PDF file. It is only available for iOS right now. On the plus side, you can create recurring expenses.

Pros

- Separate sections for utilities, rent, bills, etc.

- Option to view previous budgets

- CSV export

- Budget forecast

Cons

- Subscription model

Get Finances (free, iOS)

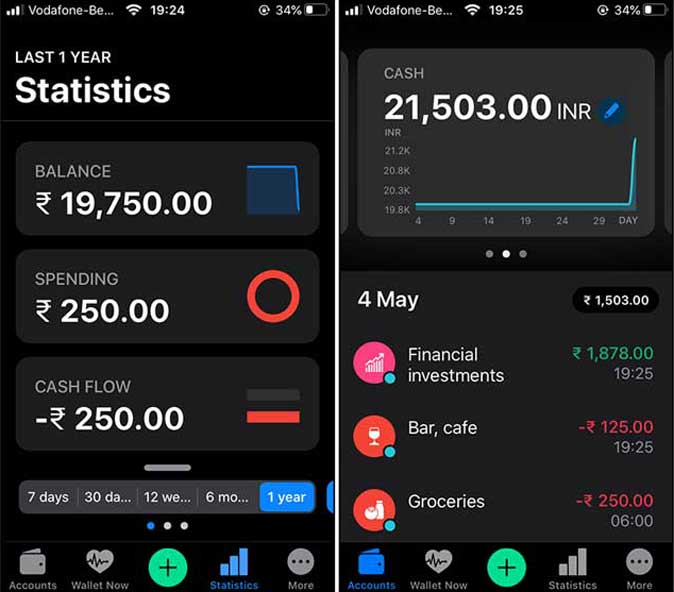

3. Wallet

Wallet is a neat app that focuses on simplifying your budget. You can create multiple accounts to organize your money. For example, one account for savings and cash based on which account you use to spend. As you log your expenses under a specific account, the list is updated automatically with a clear graph showing your spending trend.

The statistics section shows reports up to a year that include parameters such as cash flow spending, income report, etc. The only caveat that I found in the app is that the budget section is buried deep in settings that can be hard to access. However, after setting up a monthly budget, it would automatically use the income and expenses added to the app to calculate your monthly expenses.

The strongest selling point of this app is the visual representation of your spending that clearly indicates your financial trends. You can even compare your current budget with the past six months of data.

Pros

- Beautiful design language

- Statistics section

- Easy to read charts

Cons

- Budget section is hard to find in the app

Get Wallet (in-app purchases, iOS)

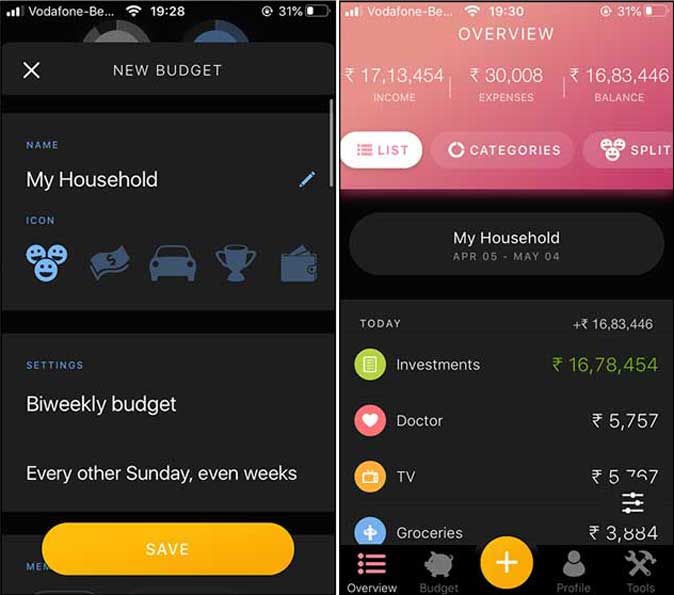

4. Wally

Wally is a professional budgeting app that is packed with features. For starters, you can link your savings or checking account with the app, and the app would fetch and log all the transactions done with that account. Creating sub-accounts and wallets is easy.

While the transactions are added automatically, you still have to manually input your expenses. However, I do like the fact that you can set reminders for any upcoming bills and expenses. Never forget to pay bills and pay penalties. Once you start using Wally regularly, it analyses your spending and shows useful insights such as your total spending, cash flow, balances, and even a ledger.

Wally does have a small learning curve but once you start using it, your budgeting skills would improve exponentially. It is best suited for users who want a comprehensive tool to track their spending automatically.

Pros

- Link savings account to automatically input transactions

- Ledger function

Cons

- Subscription model

- Complex to use at first

- No option to automatically input expenses

Install Wally (in-app purchases, iOS)

5. Spendee

Spendee is another example of a budget app for iPhone and iPad that focuses on ease of use. It has a simple transaction page where you can log all your expenses and income manually.

However, the selling point of Spendee is that you can create individual budgets for every account. For example, if you have a joint account with your spouse for household expenses, you can have a separate account for that and another wallet just for your personal expenses.

On top of that, you can add your spouse to a wallet so that you can log the expenses together from your separate phones. Spendee is an easy recommendation for couples or even roommates who want to manage the budget effectively.

Pros

- Create separate budgets

- One tap expense input

- Graphs and insights

Cons

- Subscription model

Get Spendee (in-app purchases, iOS)

6. Buddy

Buddy is truly a home budget app as it is designed while keeping a household in mind. Creating a budget is the first step in setting up the app, I like that Buddy gives you an option to create weekly, monthly, bi-weekly, and even yearly budgets. Plus, you can start a budget from the middle of the month which is a nice addition. After that, you can add multiple people to your budget but this app lets you split the cost equally, similar to Spendee.

While Buddy shares feature with apps such as Spendee and Splitwise, it offers those features in a single app which makes it an interesting sell for bachelors looking for a home budgeting app.

Pros

- Start a budget at any time of the month

- Flexibilty to create a budget of weeks to years

Cons

- Subscription model

Get Buddy (in-app purchases, iOS)

7. Grocery Gadget

Even though I use a proper budget to divide expenses, one thing I always underestimate is the kitchen items. Grocery Gadget is a budgeting app for your kitchen that lets you organize kitchen expenses efficiently. The app lets you divide household items into lists such as weekly groceries, pharmacy items, office supplies, etc.

The most intuitive feature of this app is the OCR scanner that can read and store barcodes. Although there are plenty of items already listed, I found a few that weren’t recognized by the app. Once you have a list ready, you can use it to shop for items.

To budget your groceries, simply scan an item that has run out from the pantry and add it to the shopping list. This way, you’d never overspend and always have items in stock.

Pros

- Scan groceries’ barcode with camera

- Create a weekly grocery/pharmacy budget

Cons

- Subscription model

- Not a full-fledged home budgeting app

Get Grocery Gadget (in-app purchases, iOS)

8. Account Book

Account Book is a budgeting and bookkeeping tool for small businesses and self-employed. It has comprehensive features that let you manage your accounts, transactions, salaries, and upcoming payments. On top of that, you can keep your business budget and home budget separate within the app.

Unlike home budget apps above, Account Book doesn’t have fancy charts and graphs but gets the job done with its in-depth reports of expenses and income. This app is a no-brainer if you want to keep track of your business expenses.

Pros

- In-depth analysis of expenses

- Mange home and business budgets

- Upcoming transaction alert

Cons

- The interface is comprehensive yet complex

Get Account Book (in-app purchases, iOS)

Wrap Up: Home Budget Apps

These were some of the best home budget apps that I found on the App Store. You can install them to effectively streamline your financials. I personally use Wallet as it has a really simple interface and makes logging the transactions a breeze. What do you think of these apps? Let me know on Twitter.

Also Read: 5 Best Budget Apps for Couples