PayPal is basically a standard in the online payment system. Millions of businesses and freelancers use it to send and receive payments across countries. However, there are other methods and alternatives out there that offer better service with quick money transfer and take a smaller cut compared to PayPal. We examined the most popular PayPal alternatives and came up with 7 of the best for different needs.

Best PayPal Alternatives

We are going to focus on key aspects such as security, international payments, fees, send to email payment, and an ease of use. Let’s get started.

1. TransferWise

TransferWise terms itself as a ‘cheaper way to send money internationally’ and it’s one of the best PayPal alternatives if make lots of international transfers.

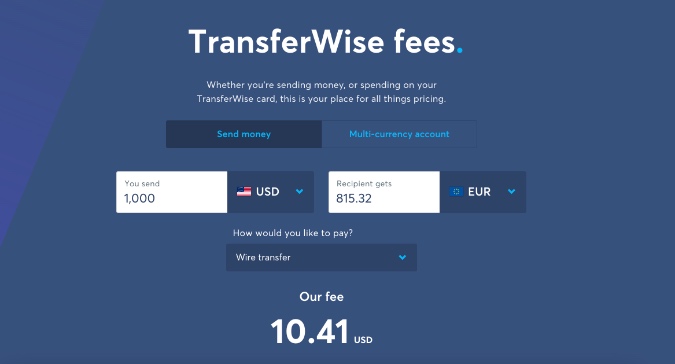

TransferWise offers the real exchange rates right on the homepage. You can calculate how much money the recipient will receive in real-time and how much cut TransferWise takes from the transaction.

For example, if you send 1000 USD to the customer or client in Europe, the receiving person will get 815.32 Euro and TransferWise takes around 10.41 USD as fees. The money is deposited directly into your bank account instead of an online account like PayPal.

That’s not all. The service’s Borderless account provides users with a debit card, allows you to manage money in more than 40 currencies, run payroll, batch payments, charge clients, and more.

Plus, with TransferWise for business, you’re able to invoice your customers in their own currency.

Try TransferWise

2. Payoneer

Not many are familiar with this but Payoneer started at the same time as PayPal and the company operates in more than 200 countries.

Payoneer has two types of accounts: one that is free and allows you to withdraw money directly into your bank account. The other account calls for a prepaid card that is only available to individuals and costs $29.95 a month. Payoneer charges a transaction fee of $1.50 for local bank transfers.

The payment solution bills your fees monthly and transactions are free between Payoneer accounts.

Unfortunately, credit card transaction fees are slightly higher than some other services, and you generally have to pay a fee when transferring money to a bank account.

Try Payoneer

3. Stripe

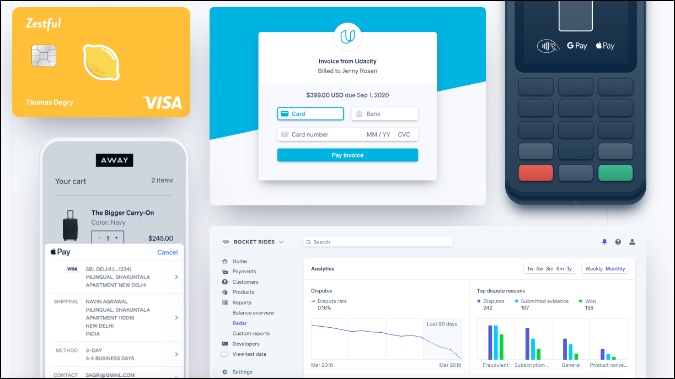

Stripe competes against PayPal for online business customers but not much else. This service is only available to U.S. and Canada-based businesses, but payments can come in from any source. Fees are very clear; Stripe charges 2.9% plus 30 cents on every transaction.

You can accept payments from all over the world. Stripe automatically deposits money into your bank account – plus, mobile payments are available.

The downside? Unfortunately, the transaction fees are very similar to PayPal’s. And you need to have some programming know-how to get flexible with the platform.

Try Stripe

4. Google Pay

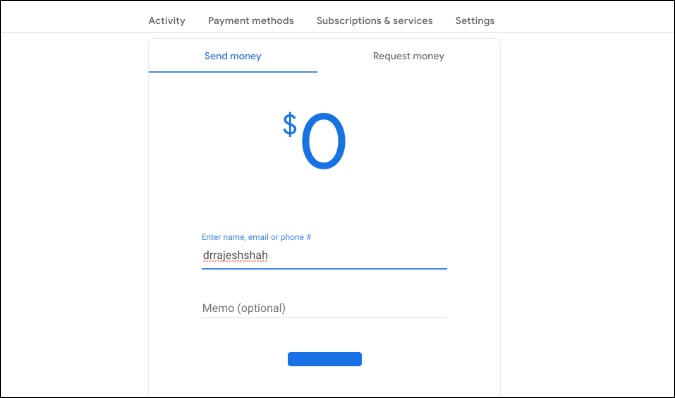

This one is a straightforward and cool alternative to PayPal. Google Pay is a simple way to pay on websites, in apps, and in-store using cards saved to your Google account. Simply add your credit and debit card payment details to your account, and enjoy faster, more convenient payments, wherever you are.

Like PayPal, Google Pay Send is great for sending money to and from anywhere for virtually any reason, but Google Pay Send does not charge a fee on debit transactions, whereas PayPal charges 2.9%.

There are no setup or cancellation fees for Google Pay Send, and it is available for Android and iPhones. The biggest advantage for Google Pay Send is the merchant function that allows for a variety of tools to manage your business and incorporate loyalty programs and other advantages.

Try Google Pay

5. Skrill

Skrill allows you to send and receive money, store cards, link bank accounts, and make payments with just your email address and password. Skrill wallet holders also only pay fees of 1.45%, so you get to keep more of the money from every transaction. Whether you’re using Skrill for business or personal use, you’ll receive access to global support in more than 30 countries.

The payment solution also provides a prepaid debit card that you can use around the world. Plus, moving money to your bank account takes no time at all.

Skrill was created with cryptocurrencies in mind, like Bitcoin, Ether, and Litecoin. It’s also set up for gambling and other online games which require funds.

Try Skrill

6. Square

Owned by Twitter founder Jack Dorsey, Square one of the best PayPal alternatives. Simply select your business size and type and you are set to start with a Square account. Square’s features aren’t just limited to accepting cards, though. You can get paid for invoices, use the app for your online store, or manually key numbers in to take payments by phone. Fees vary from 2.6% + $0.10 for swiped cards to 3.5% + $0.15 for manually keyed transactions.

In addition to payment, Square also offers inventory management and loyalty programs. Robust reporting lets you track your income and inventory levels without having to link to other software. You choose only the tools you need for a fully customized solution.

Cherry on top? You can also swipe cards without a connection, so you never have to worry about losing business because of outages again.

Try Square

7. Venmo

Venmo is a subsidiary of PayPal but still an alternative. It’s highly popular among the young generation. It’s a digital wallet that allows users to send money to their contacts. It’s somewhat personal, too. You can leave comments about a transaction just like a social media platform.

Venmo is typically used to send money to someone you know personally instead of writing them a check. For example, if you go to a restaurant and want to pay your friend for a meal then you can use the Venmo platform to send money.

Venmo also lets users pay in-app for online purchases through PayPal, and it tracks what they’ve bought. This can be an advantage to you in that your information is on hand if the customer wants to make another purchase.

The company has rolled out Venmo for Business that allows businesses to create a profile and accept payments for a low 1.9% + 10 cents transaction fee.

Try Venmo

Wrap Up: Ditch PayPal for Alternatives

Go through the list above and based on your requirements, you can start with either of the services and be completely fine without worrying about the next payment.