While doing the yearly audit I noticed, I’ve paid late fees on my credit card twice in the past year. Now, since it’s my secondary credit card, I’d not paid much attention to it. But what’s done is done. I finally ended up canceling my card, and to prevent this in the future, I googled for the best credit card management app, but no luck. So I figured why not do the research myself and share it with other users. Turns out, credit card management apps are not just useful to track late fee but offers some other benefits and drawbacks as well.

Advantages of Credit Card Management Apps

- Get timely reminders

- Pay bills on time

- Avoid late payment fees and charges

- Earn reward points (depends on the app)

- Manage all cards at one place

- Check balance, payments, due dates

- Create budgets, plan expenses in advance

Disadvantages of Credit Card Management Apps

- Share data with app developer/company

- Grant access to manage cards

- Failure to pay in time results in fees

While there are some caveats to using credit card management apps, for the most part, they are a pretty useful personal finance planning and budgeting tool. Note that some users have experienced late payments resulting in fees that they had to bear but such instances are once in a blue moon event. The benefits far outweigh the drawbacks in my opinion. Here are some of the best credit card management apps for Android and iOS users in no particular order. It’s a question of convenience.

1. Credit Card Manager

The main benefit of Credit Card Manager app is that it works offline, completely. This means none of your precious data will be shared with anyone, not even the developers. On the flip side, this means that you have to enter data manually. If you own a single card, that’s still doable but if you have more than one, it can be a chore.

Also Read: Best Expense Tracker Apps for Android and iOS

You begin by entering credit card details like due dates, transactions, bank names, and any fees that you are aware of. The app will then remind you to pay bills, record transactions, mark as paid, outstanding balance, reminders for waivers, and interest-free period so you can pay credit card bill which is due first.

Credit Card Manager is free to use however comes with ads. Pro version will cost $5.99 onetime.

Pros

- Offline

- Reminders

- Record transactions

- Show balances

- Statements

Cons

- No cross-platform compatibility

- Record everything manually

- Can’t pay from within the app

- No deals or discounts

Download Credit Card Manager (Android only)

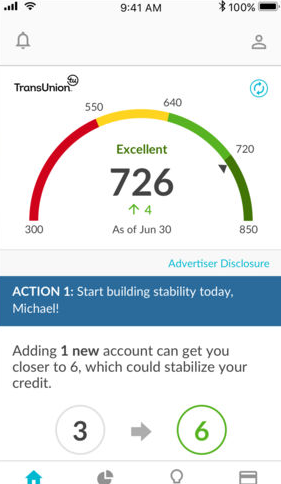

2. Credit Karma

What happens when you don’t pay your bills on time? Your credit score is affected. Which credit card should you apply for? There are quite a few to choose from. Credit Karma will help you answer these questions. You can view your credit score, file taxes at the end of the financial year, and monitor your credit score.

What I like about the app is that Credit Karma often recommends me interest saving offers and get the maximum rewards on my credit card. Tracking these things can be a chore, but not anymore. If you own more than two credit cards, the app will tell you which one should be paid first to improve credit score immediately and save the maximum in late fees. Finally, you can learn about unclaimed money like tax refunds, pensions, and more.

Credit Karma is completely free and will act as a companion app to your credit card payment app.

Pros

- View, monitor credit score

- Manage rewards

- Know about ID theft

- Less interest rate

- Offers and deals on cards

- Pay taxes

- Find unclaimed money

Cons

- Can’t pay credit card bills

- No way to enter or monitor transactions

Download Credit Karma (Android | iOS)

3. Credit Sesame

Credit Sesame works similarly to how Credit Karma operates, however, there are some subtle differences. Credit Sesame takes into account the TransUnion score which is based on VantageScore. Credit Karma, on the other hand, works with both TransUnion and Equifax. Though the exact formula is unknown, the later should paint a better picture.

You can learn about your credit score, which credit cards should you apply for, what offers and rewards are currently available for you, and in-depth reports that help you understand how your credit score has improved (or not) over time. Finally, there is ID theft protection.

Pros

- View, monitor credit score

- Manage rewards

- Know about ID theft

- Less interest rate

- Offers and deals on cards

- Borrowing power

Cons

- Can’t pay credit card bills

- No way to enter or monitor transactions

- Only TransUnion score

Download Credit Sesame (Android | iOS)

4. Mint

Mint is one of the most famous and feature-rich credit card management apps available right now. In fact, you can do so much more than just manage your credit cards with Mint. You can track account balances from savings, current, credit, loan, pension, and so many other sources.

With so much info available on a single screen, you can plan budgets more effectively, pay off bills and debts systemically, and follow your finances more efficiently. Mint is too powerful and diverse to be covered here but you will get everything you need to know about your credit cards, rewards, reminders, and more under a single roof.

Pros

- View, monitor credit score

- Reminders

- Balances, statements

- Pay bills inside Mint

- Reports

- Budgets

- Goals

- Manage rewards

- Pulls data automatically

- Pay taxes

Cons

- None

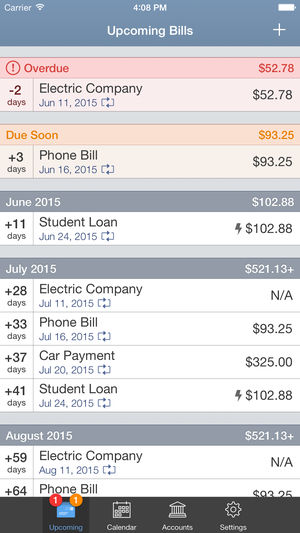

5. Bill Tracker

Think Mint is too powerful for you? Need something simpler and easier to use? Bill Tracker is an iOS-only app that will let you track and pay credit card bills in time. In fact, the nifty little app can be used to track any type of bill and not just credit cards. There is a calendar view to plan in advance.

Also Read: 6 Best Calculator Apps for Android for Different Need

Note that it will not pull data directly from your credit card account but you can enter details like amount, due dates, etc. manually and set repeating reminders. Bill Tracker will cost you $2.99 and is suitable for users who want something simpler and don’t want to share their info with 3rd party apps.

Download Bill Tracker (iOS only)

6. Prism

Prism is a bill tracking app too however it is much more advanced and integrates with a number of billers across the world. These billers also include credit card companies. Just enter your account details and Prism will pull data right in your Prism account. One place to pay all credit card bills.

Prism is free to use and will process your payments the same day with no processing fees. There is a handy calendar for those who like visual data and carry multiple credit cards in their wallets. Don’t have funds? You can schedule a bill payment and it will be paid automatically. Just set it and forget about it.

Prism is completely free and is more suited for people who are looking for an app to manage all sorts of bills and not just credit cards., however, it works great for just that too.

Pros

- Schedule payments

- Pay bills automatically

- Pay bills inside Prism

- Reminders

- Calendar

- Reports, graphs

Cons

- No credit card score

- No rewards

- No suggestions on choosing a credit card

Download Prism (Android | iOS)

7. Cred

Cred is a credit card rewards program app that will pay you Cred points for paying your credit card bills on time. If late fees do not motivate you, maybe rewards will? Anyway, Cred has seen a lot of success with users and though founded in India, it is also available in the US region.

Also Read: 5 Best Budget Apps for Couples (2018)

You create an account with Cred and they will check your credit score which is linked to your phone number. If the score is above 750, you will be accepted, otherwise, you join a waitlist. Once in, you will get reminders for paying bills and earn coins that you can use to get rewards. Cred is completely free to download and use which makes me wonder how these companies survive without ads or any other means of revenue.

Pros

- Credit score

- Rewards

- Reminders

- Pay bills with Cred

- Reports

Cons

- No credit card suggestions

- No autopay or schedule payments

8. Tally

Are you in debt? Like credit card debt? Tally promises to get you out of it by managing your credit cards more effectively. One of the few credit card management apps for Android and iOS that works with FICO score, Tally will help you save money by giving you a lower interest rate line. What’s that?

In case of a date is due and you don’t have enough money, Tally will make the payment but with a lower interest rate than the bank. This way, you will save some money on late payment associated fees and interest. A novel concept for those who do not have enough cash flow or liquidity.

Download Tally (Android | iOS)

Credit Card Management Apps

There are quite a few options available in the market. I would suggest Mint if you want a complete account and financial management app. Bill Tracker and Prism are more suitable for those who just want to consolidate and automate the process of paying bills across a range of categories and not just credit cards. If cash flow is your problem, Tally will serve you well. Credit Karma for those who are worried about their credit score and want to improve it.